Tech giant SoftBank has suffered a massive loss of $14.4 billion as a result of its investment in WeWork, the office-sharing company that recently filed for bankruptcy. This substantial financial hit was revealed in SoftBank’s earnings report for the period of July to September, which also included a total loss of $6.2 billion for the same time frame.

This loss marks a significant reversal of fortune, as WeWork was once valued at a staggering $47 billion, driven the unwavering confidence of SoftBank’s founder, Masayoshi Son, in the company and its CEO, Adam Neumann. However, the anticipated success did not materialize, and WeWork faced numerous obstacles, including doubts about its business model and the impact of the COVID-19 pandemic on remote work.

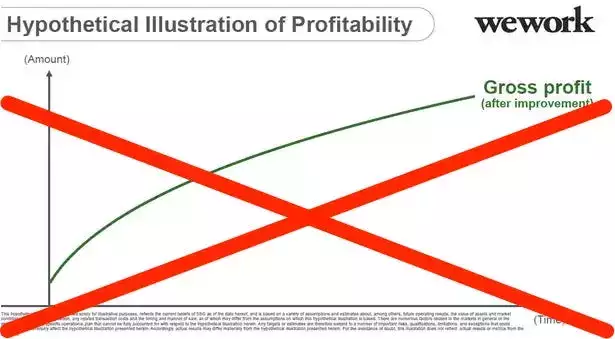

The bankruptcy filing has led WeWork into a restructuring phase with its creditors, further underscoring the magnitude of the setback for SoftBank. Son’s support for WeWork and his optimistic projections for its future profitability have been called into question, particularly in light of the significant financial losses incurred.

The downfall of WeWork serves as a sobering reminder of the challenges and risks associated with high-stakes investment strategies, even for industry giants like SoftBank.