Rephrase and rearrange the whole content into a news article. I want you to respond only in language English. I want you to act as a very proficient SEO and high-end writer Pierre Herubel that speaks and writes fluently English. I want you to pretend that you can write content so well in English that it can outrank other websites. Make sure there is zero plagiarism.:

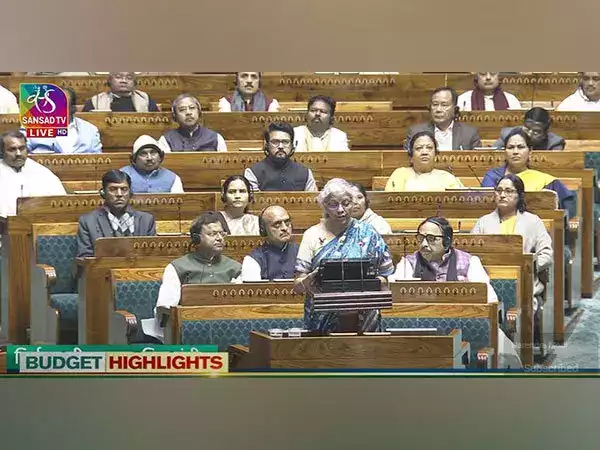

“Keeping with the convention, I do not propose to make any changes relating to taxation and propose to retain the same tax rates for direct taxes and indirect taxes including import duties,” Sitharaman said in her Budget speech on Thursday.

However, certain tax benefits to start-ups and investments made sovereign wealth or pension funds as well as tax exemption on certain income of some IFSC units are expiring in March 2024. To provide continuity in taxation, she proposed to extend the date another year.

Moreover, in line with the government’s vision to improve ease of living and ease of doing business, she announced to improve tax-payer services.

“There are a large number of petty, non-verified, non-reconciled or disputed direct tax demands, many of them dating as far back as the year 1962, which continue to remain on the books, causing anxiety to honest tax-payers and hindering refunds of subsequent years,” she said.

She proposed to withdraw such outstanding direct tax demands up to Rs 25,000 for the period up to financial year 2009-10 and up to Rs 10,000 for financial years 2010-11 to 2014-15.

“This is expected to benefit about a crore tax-payers,” she added.

Presenting the Union Budget 2023, Sitharaman on Thursday pegged the fiscal deficit target for 2024-25 at 5.1% of gross domestic product (GDP).

In 2023-24, the government pegged the fiscal deficit target for 2023-24 at 5.9% of gross domestic product (GDP). Today, Sitharaman said that the fiscal deficit of 2023-24 was downwardly revised to 5.8%.

The difference between total revenue and total expenditure of the government is termed as fiscal deficit. It is an indication of the total borrowings that may be needed the government.

The government intends to bring the fiscal deficit below 4.5% of GDP the financial year 2025-26.

The government intends to bring the fiscal deficit below 4.5% of GDP the financial year 2025-26. A capital expenditure, or capex, is used to set up long-term physical or fixed assets.

Last year, which was the last full Budget under the Prime Minister Narendra Modi-led government’s second term, the government proposed to increase capital expenditure outlay 33% to Rs 10 lakh crore in 2023-24, which was estimated to be 3.3% of the GDP.

With the substantial increase in capex, it is central to the government’s efforts to enhance growth potential and job creation, crowd in private investments and provide a cushion against global headwinds.

The interim budget, tabled today, will take care of the financial needs of the intervening period until a government is formed after the Lok Sabha polls after which a full budget will be presented the new government in July.

With this Budget Presentation, Sitharaman equalled the record set former Prime Minister Morarji Desai, who as finance minister, presented five annual budgets and one interim budget between 1959 and 1964.

The Budget Session of Parliament commenced on Wednesday with President Droupadi Murmu addressing a joint sitting of Lok Sabha and Rajya Sabha.

The Indian economy is projected to grow close to 7% in the financial year 2024-25 which starts this April, said the Ministry of Finance in a review report.

India’s economy grew 7.2% in 2022-23 and 8.7% in 2021-22. The Indian economy is expected to grow 7.3% in the current financial year 2023-24, remaining the fastest-growing major economy.