Rephrase and rearrange the whole content into a news article. I want you to respond only in language English. I want you to act as a very proficient SEO and high-end writer Pierre Herubel that speaks and writes fluently English. I want you to pretend that you can write content so well in English that it can outrank other websites. Make sure there is zero plagiarism.:

- Funding winter of 2022-2023 is a stark reminder that growth at all costs, without the backbone of profitability, is a path to ruin.

- The industry also witnessed unethical practices like circular trading, further complicating the landscape.

- By mid-2024, the market should stabilize, presenting opportunities for investors with cleansed portfolios and profitable ventures.

In 1999, amidst the dot-com frenzy, Warren Buffett’s prophetic words at the Allen-Sunny Valley Conference foresaw the bubble’s burst. I witnessed this, my first tech bubble-bust, firsthand as a 16-year-old trader in my dad’s office. At that time, companies, merely donning a “tech” or “soft” label, saw their valuations soar. This pattern, a rollercoaster of tech stock highs and lows, has been a recurring theme in the two-plus decades since and is especially pronounced in India.

The 2021-22 period, a time marked soaring valuations and new paradigms for appraising tech companies, was no exception. Deep down, we knew this hyper-growth was unsustainable. The subsequent ‘funding winter’ of 2022- 2023 is a stark reminder that growth at all costs, without the backbone of profitability, is a path to ruin. The recent downturn reiterates a lesson we’ve seen repeatedly over the years: the frenzy around valuation and growth must be tempered a return to fundamental business principles. As I’ve observed in my 24 years of investing, this boom and bust cycle is an old story, teaching us the same lesson each time.

In the late 90s, eyeballs and clicks were the valuation cornerstone, mirroring the recent era where ‘scale’ overshadowed real profitability. The trend of scaling at all costs, ignoring the fundamentals of Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratios, led to inflated valuations. I saw companies claiming large revenues, but after stripping away GST, discounts, and direct costs, what remained was merely ‘foam’—insubstantial.

Investors, caught in a frenzy, were willing to pay exorbitant multiples on inflated revenues. A company claiming ₹24 crore in annual revenue, in reality, had just ₹9 crore, yet it fetched valuations of ₹240 crore. This discrepancy was exaggerated a period of low-cost money due to global quantitative easing. However, as interest rates rose, these overvalued, cash-burning ventures crumbled, unable to sustain their business models without cheap capital.

As the cost of capital has skyrocketed, the focus has rightfully shifted back to profitability, a lesson reiterated in each market cycle. The bottom line after taxes, not inflated revenue figures, truly determines a business’s value. While burning cash may be viable temporarily, a clear path to profitability is essential, regardless of the industry.

Let’s not absolve investors, either. Many lowered their standards in their race to be seen as dynamic and founder-friendly. They prioritized deal-winning over diligence, forgoing governance and oversight. This approach turned them into mere brokers, seeking higher valuations for their investments rather than actual returns. This corrupted ecosystem was primed for a crash, and deservedly so.

During the investment frenzy, there were ventures with strong, viable business models that didn’t initially catch investors’ eyes. These businesses, grounded in consumer loyalty and solid financials, were overshadowed cashburning counterparts. Many founders, under the sway of investor expectations, pivoted from profit-generating models to cash-intensive operations.

However, ventures like Physicswallah, Zerodha, and Everest Fleet, which stayed true to their profitable roots, eventually took center stage.

This shift wasn’t easy, especially for businesses ingrained in a culture of heavy spending. Reducing marketing and operational costs, essential in leaner times, led to revenue dips for many. The industry also witnessed unethical practices like circular trading, further complicating the landscape. Looking towards 2024, I foresee a challenging first half for businesses reliant on high valuations. We’ll likely witness mergers, substantial down rounds, or pivots to more sustainable models.

By mid-2024, the market should stabilize, presenting opportunities for investors with cleansed portfolios and profitable ventures. Sectors like space tech, fintech infrastructure, RegTech, and enterprise SaaS are poised for growth, driven strong problem-solving capabilities and profitability potential.

This shift back to business fundamentals underscores a crucial lesson: innovation can’t override the need for a profitable bottom line. No matter how groundbreaking the technology, its existence is questionable if it doesn’t lead to a sustainable business model. As we embrace this evolution, 2024 might end on a high, heralding a new era of rational, value-driven investments.

In conclusion, 2024 will be an exciting year for investing.

As a favourite saying from one of my beloved Batman movies goes, “The night is darkest just before the dawn.” In these funding winters, long-term winning investments can be found, separating the hay from the chaff. In these markets, winning investments are discovered, and unique businesses are at fantastic valuations.

Think about the wealth creation Amazon and Infosys have had since their lows of 2000 or Microsoft and HDFC since their lows of 2010. Investors who have been prudent, sitting on cash, waiting for the market to return to normalcy, will find exceptional opportunities at fantastic prices. I expect 2024 to end on a very high note.

Investors will get opportunities to buy out positions or to get into companies that are doing great work but have chosen the wrong path to gaining investor eyeballs, which would require capital to mend the errors. All of these will find opportunities in 2024. So, I expect 2024 to be a fantastic year for investing. I’m supremely excited. Here’s to a fantastic 2024, and seeing you in the cap tables of 2024’s success stories.

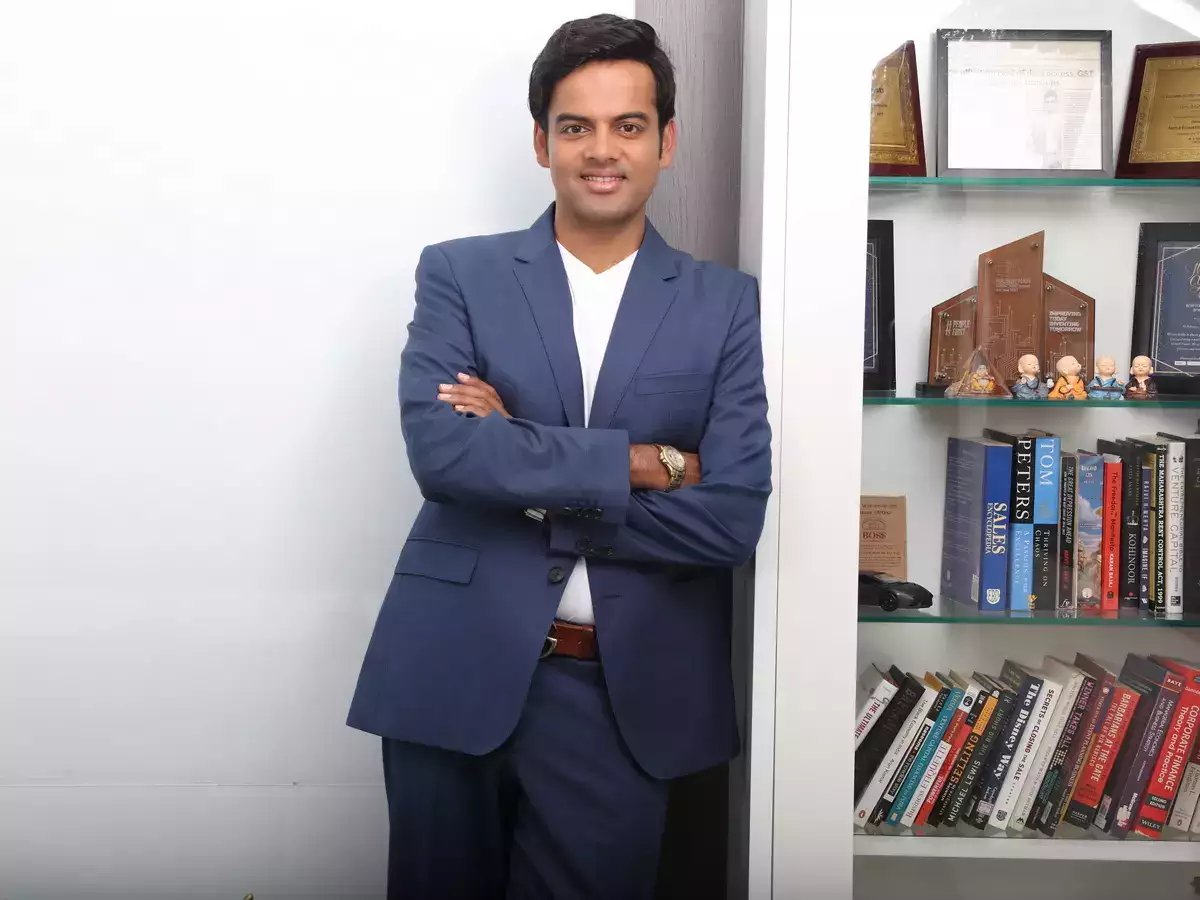

(The author is the managing partner at Artha Venture Fund.)