Rephrase and rearrange the whole content into a news article. I want you to respond only in language English. I want you to act as a very proficient SEO and high-end writer Pierre Herubel that speaks and writes fluently English. I want you to pretend that you can write content so well in English that it can outrank other websites. Make sure there is zero plagiarism.:

- The Indian life insurer stood fourth on the list S&P Global based on reserves.

LIC has reserves of over $500 billion, as per the report.- Sector watchers say that Asia is the next major market for growth for

life insurance companies.

Public sector life insurance behemoth, Life Insurance Corporation of India (LIC) is the world’s fourth largest insurer based on reserves, as per a report released S&P Global Market Intelligence.

LIC follows Allianz SE, China Life Insurance and Nippon Life Insurance on the list of top largest life insurers. LIC has reserves of $500 billion while Nippon’s reading is at $536 billion. China Life Insurance has $616 billion, and Allianz SE has $750 billion in reserves.

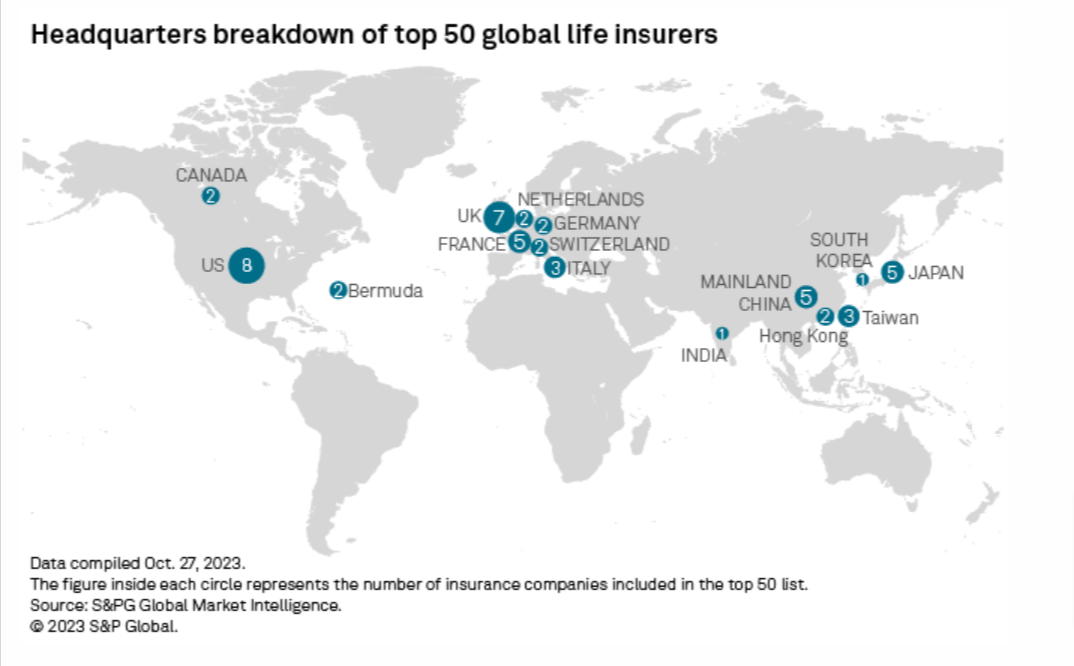

Asia accounts for 17 spots on the list of top global life insurers, making it the region with the second-highest number. Mainland China and Japan shared the top spot in Asia with five companies headquartered there.

European companies from six countries dominated the list of top 50 global life insurers ranked life and accident & health reserves, taking 21 spots.

Karl Hersch, Deloitte’s US insurance leader, expects the life industry to experience tempered levels of growth in the US and Europe in light of macroeconomic factors while seeing more opportunities in emerging markets.

“The growth I’m expecting to see is more in the emerging markets where you already have a higher underserved population and there’s more opportunity,” Hersch said.

Rob Sims, managing director and partner with Boston Consulting Group’s insurance practice, is seeing the rise of a more digitally-led experience in Asia than anywhere else in the world.

An area of concern for the life insurance industry, as pointed in the report, is the difficulty to adapt to large-scale transfer of wealth from one generation to the next.

“There’s not a single area in the world that isn’t going to be experiencing that wealth transfer. The life insurance industry is not yet ready to address this challenge as it does not have the right products and technology,” said Samantha Chow, global leader for the life, annuities and benefits sector at Capgemini.

The LIC stock has been on the path of recovery having rallied 20% in the past six months. The past month has seen the stock gain as much as 16% in value.

LIC Chairman