Title: Understanding the Tax Implications of Minors’ Income

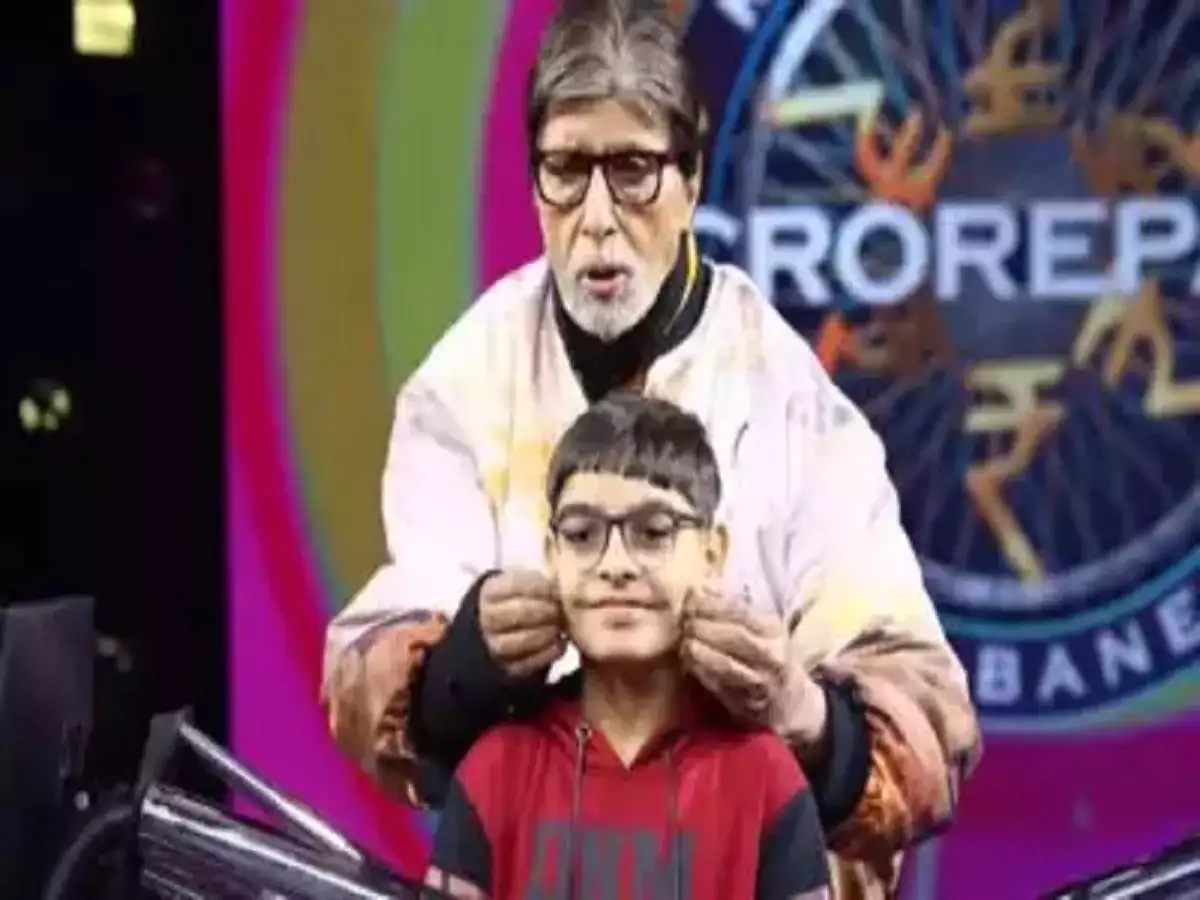

When it comes to the income of minors, it is important to distinguish between two forms of income – earned and unearned. Earned income, such as prize money won in contests like ‘Kaun Banega Crorepati,’ is not clubbed with the parent’s income. Minors are also subject to a flat tax rate of 30% on this type of income, according to section 115BB of the Income Tax Act.

Unearned income, on the other hand, includes gifts, interest earned through savings or investments, and is taxed differently. If a minor’s income exceeds ₹1,500 annually, it is clubbed with the parent’s income for tax purposes.

When it comes to investing on behalf of a minor, such as through bank fixed deposits or mutual funds, there may be tax implications to be aware of. Income from these investments falls under the category of unearned income and is taxed accordingly.

Additionally, minors are required to have a PAN card and file their own income tax returns when they have generated income from sources like contests, sports, or part-time work. Understanding these tax implications is important for both the minors and their parents to ensure compliance with the Income Tax Act.